Summary

Welcome back to another Token Holder Update! Last month, OGN buybacks accelerated alongside protocol earnings, crossing 11 million OGN bought back. This pushed staking rewards well into the double-digits, drawing in more OGN locks and reinforcing confidence in Origin’s new staking model.

The stETH ARM also saw strong momentum, with TVL more than doubling in August and yields continuing to outperform liquid staking tokens. Growing demand from institutional participants further validated the ARM’s role as a differentiated yield source in DeFi.

Here’s what Origin delivered in August:

Origin Token (OGN): August 2025

OGN staking has entered a new phase of growth. Staking rewards on max locked xOGN are now tracking at ~50% APY, funded entirely through protocol fees with no new token emissions.

Staking participation climbed significantly in August, with more than 20 million OGN newly locked to earn rewards. Over 11 million OGN ($710,000+) has been bought back since June, underscoring the strength of the new model and reinforcing OGN as a core beneficiary of protocol success.

stETH ARM Growth and Product Development

The ARM continued to expand rapidly in August, with TVL growing by more than 150%. stETH ARM yield held strong throughout the month, achieving 6.2% APY over the trailing 30 days. Yield improved due to a major vault upgrade that now routes ETH into MEV Capital’s Morpho vault to capture additional lending yield.

Institutional adoption also accelerated — allocations from MEV Capital highlight growing confidence in the ARM as a core yield primitive. On top of this, ARM vault tokens are beginning to see integrations across DeFi, creating new strategies and use cases for LPs.

Ecosystem Updates

Origin achieved new integrations in August, expanding how our products can be used in DeFi. Here are some of the top integrations we’re excited about:

- Summer.fi increased its OETH allocation on the Lower Risk ETH Vault, which now holds over $4.5M in Origin Ether.

- Levva Finance launched its Origin Vault, enabling depositors to earn double-digit ETH yield thanks to new incentives granted by the protocol.

- Pendle integrated stETH and OS ARM Vault tokens, creating a new use case on Pendle for speculating on the LST pegs and earning fixed ARM yield.

- MEV Capital and ETH Strategy allocated to Origin products last month, increasing TVL and protocol fees generated by OETH and the stETH ARM.

- Pendle launched a new market for Origin Dollar (OUSD), allowing users to trade Origin Dollar yields and lock in fixed rates.

Product Metrics

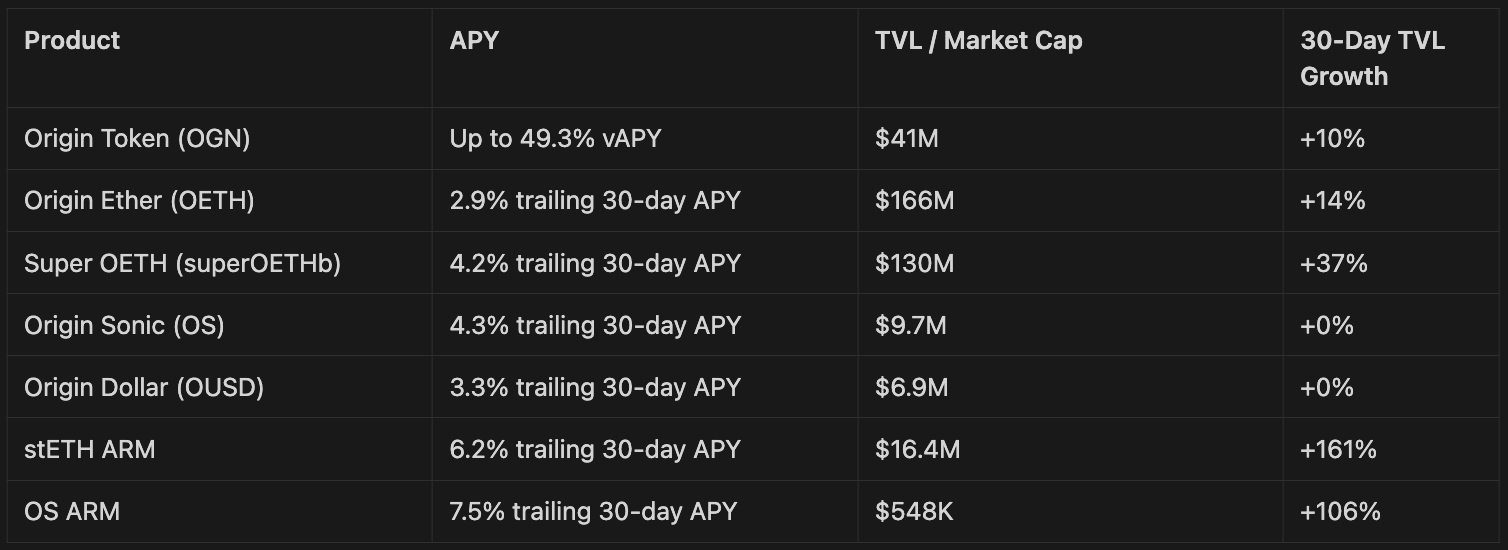

View the table below for an overview of yield, TVL, and TVL growth for all of Origin’s products:

In Case You Missed It

That’s all for our August! Thanks for reading through this month’s Token Holder Update, and we’re excited to share more developments as we expand our products to drive more value to Origin Token. In the meantime, here are some of the pieces of content you may have missed from last month:

- ARM Vault Growth and MEV Capital Partnership

- Pendle and Silo Incentives Live for Origin Sonic

- Alpha Access Livestream Recording

As always, we invite you to join our community on Discord and follow along with Origin Protocol on X.